Additional company investors are turning to seed-phase investing to get early publicity to new technologies. But it demands a different ability set to what CVCs are used to.

Image by Vitolda Klein on Unsplash

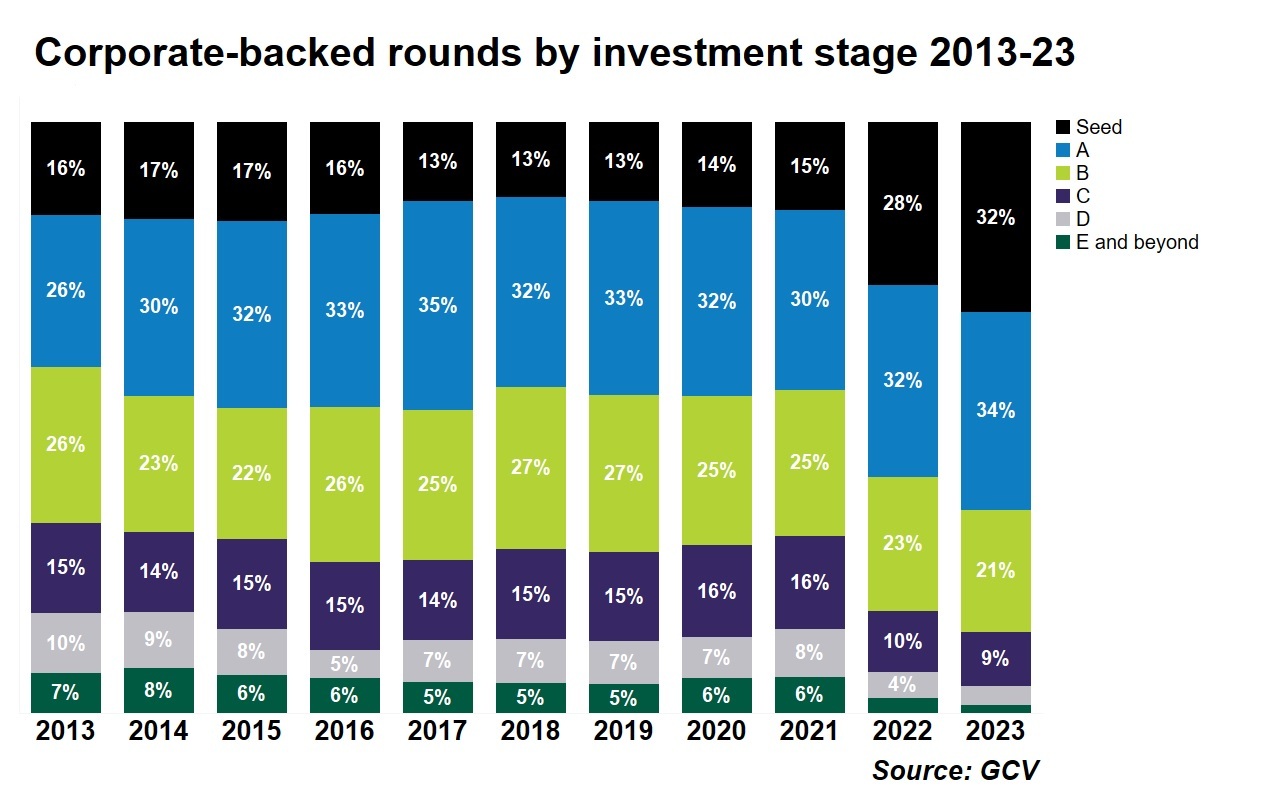

Company traders commonly tended to invest in later on-phase startups — kinds that by now experienced a operating merchandise or have been ripe for partnership offers. But in the past two years corporate traders have increasingly participated in seed phase funding rounds (previously than series A), shifting the perception of what regular company undertaking money is interested in.

Seed stage funding rounds accounted for 32% of all the corporate-backed funding offers in 2023, according to Worldwide Company Venturing’s Keystone study information, much more than double the part viewed in 2021.

Corporates have several explanations for shifting to investments in seed stage providers. A person is the inflated valuations in excess of the earlier number of decades for afterwards-phase undertaking bargains. “Where businesses have been overvalued, it can make negotiation challenging and also raises risks of transactions not completing,” says Bruce Niven, head of strategic venturing at oil and fuel enterprise Saudi Aramco. The CVC a short while ago commenced performing extra early-phase discounts.

Seed-stage investing also provides corporates early entry to strategically crucial innovations. By investing in a substantial volume of early-stage firms, businesses have much more publicity and visibility to quite a few much more systems.

“Part of our mission is to teach the mothership about the hottest systems,” suggests Tom Gibbs, senior expense director of Debiopharm Innovation Fund, a seed investment fund for Swiss biopharmaceutical company Debiopharm. “The earlier you go, the further you see into the long term.”

For freshly launched CVC units early-stage investing is also about developing manufacturer. Cheque sizes are smaller for seed investments and organizations can do a considerably

:max_bytes(150000):strip_icc()/GettyImages-1751834114-dbed438a5a604136994315d8d8f93e91.jpg)