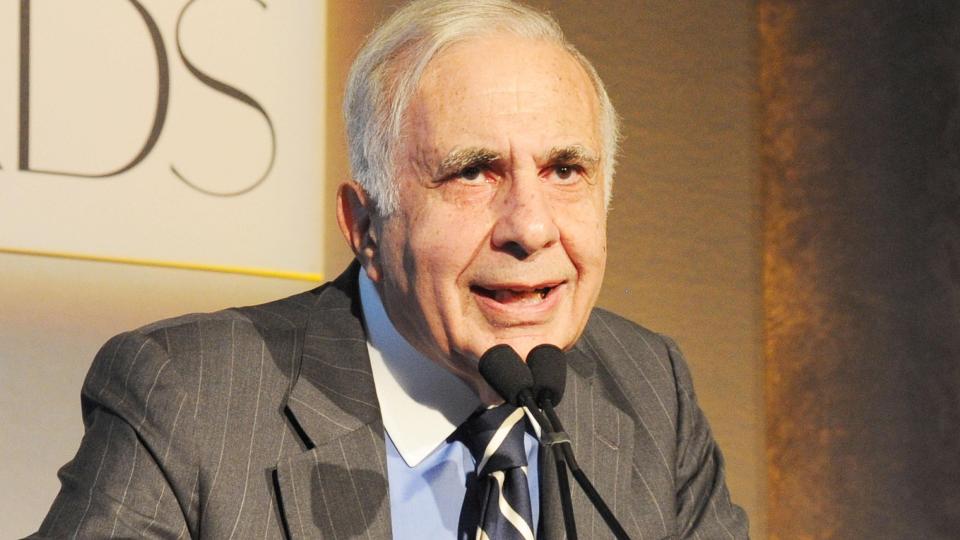

Activist investor Carl Icahn — a Wall Street legend and chairman of publicly traded Icahn Enterprises — has a web really worth standing at $6.11 billion, in accordance to the Bloomberg Billionaires Index.

Examine Out: 10 Worthwhile Stocks That Could Be the Following Apple or Amazon

Study Following: 6 Genius Factors All Rich Folks Do With Their Dollars

As The Motley Fool described, Icahn — likewise to fellow billionaire trader Warren Buffett — believes in a worth investing system.

Sponsored: Owe the IRS $10K or additional? Agenda a Free session to see if you qualify for tax reduction.

Getting a Inventory When No A single Wishes It

“Generally, Icahn is intrigued in investing in shares whose rates don’t thoroughly replicate the businesses’ whole possible. Icahn has said he purchases into a corporation when ‘no just one wishes it,’” The Motley Fool indicated.

Yet, not like Buffett who is recognized for his keeping strategy, Icahn is “willing to sell his shares to lock in revenue the moment the marketplace figures out a company’s true benefit,” The Motley Idiot added.

“I don’t know that we disagree fully,” Icahn told CNBC about Buffett in 2022. “I feel we’re to a specified extent in a diverse enterprise with Warren. I’m an activist,” Icahn mentioned. “I look for a enterprise that’s, in my brain, way undervalued these kinds of as [Southwest Gas], and there is a little something I can do about it. That is what I appreciate performing. That is why I come to operate every single working day.”

Although he has prolonged-phrase holdings, his method is a lot more oriented towards making shorter-term bets on stocks.

Master Extra: 8 Greatest Cryptocurrencies To Devote In for 2024

Currently being an Activist Trader

Icahn has a reputation as